Important Goals For Many Retirement Portfolios

Retirement typically means a change in lifestyle – and investment strategy. Protect the money you need to for today and grow the money you need down the road.

As an advisor working with a diverse client base, I am in a unique position to see people at different inflection points in their life. One of the most difficult transitions that many investors make is from employment into retirement. We talk about financial independence or retirement being the goal – we look forward to it; we celebrate it – but the reality is that it can be a difficult change.

Many of us wrap a large part of our personal identity into our professional identity. What we do can become a big part of how we see ourselves. We build communities in the groups we work in, and tend to spend large chunks of our lives becoming experts in our field. Leaving that behind for a week full of Saturdays can be scary in its own right and the financial shift you have to make can be just as daunting.

You’ve likely spent most of your professional life building a nest egg. Through some combination of diligent and recurring savings and the compounded growth in your investing, you’ve finally reached that level of financial independence. And after the final paycheck gets cashed, the majority of the heavy lifting now typically needs to be done from your investment portfolio.

Make no mistake: This may be unnerving.

I would argue that your investing goals should shift to accommodate your new reality. You probably no longer have one singular goal of building a nest egg, but now two…

Goal 1: Protect the money you need in the short term from the volatility of the market.

Goal 2: Continue to grow your long-term purchasing power so that inflation doesn’t erode your buying power.

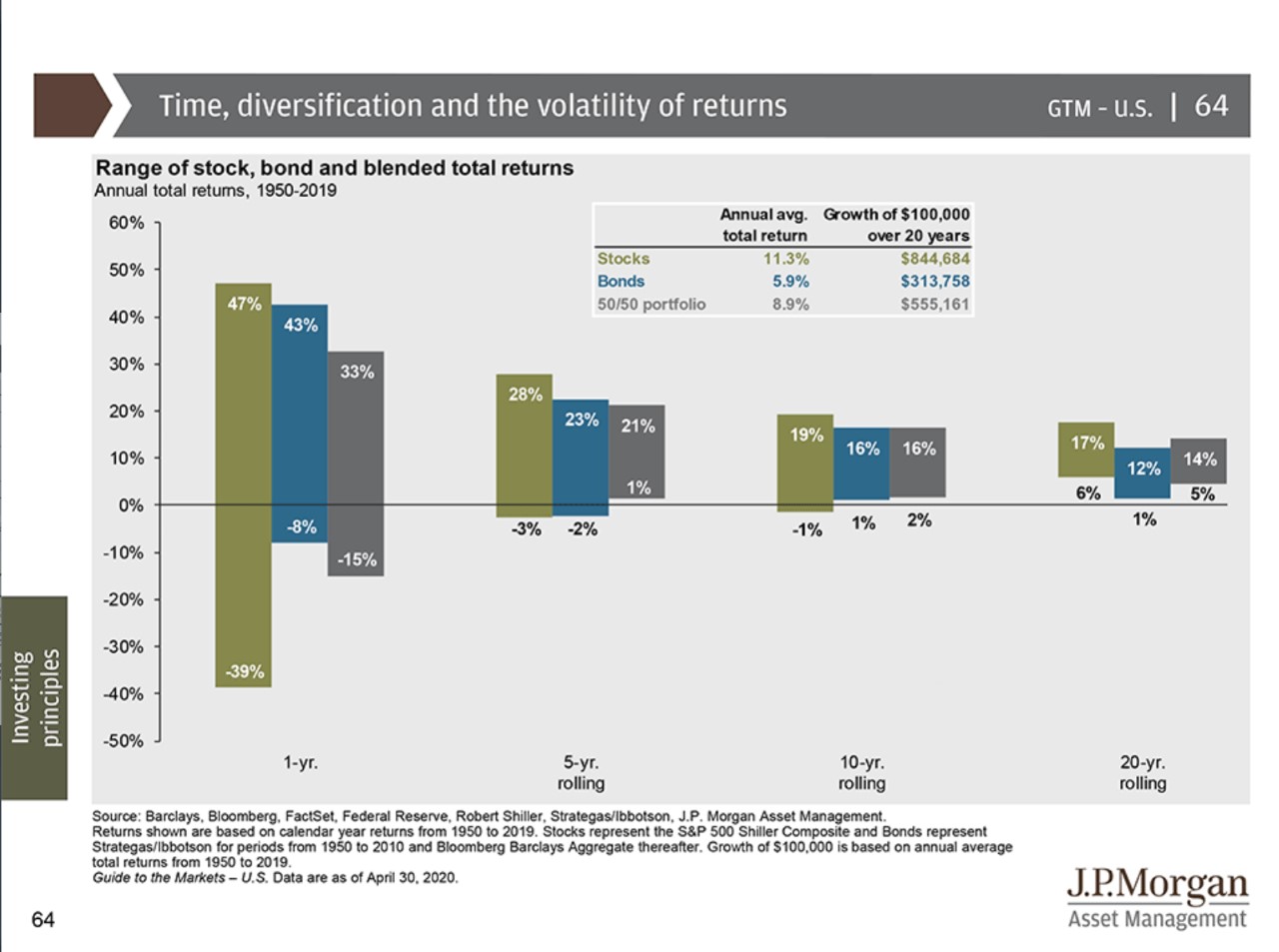

Here’s the issue: Over long periods of time, stocks are statistically the best performing asset class. But in any single year period you have historically seen upside of as much as 47% and downside of as much as 39%.

We want to avoid a situation where we are needing to draw from your portfolio while stocks are in a meaningful drawdown. As a result, you may need to start building a pool of safer money that won’t be (as) affected if stocks are in a negative stretch.

At the very least, I usually recommend starting to think about this in the 5 years as you’re approaching retirement, not just as you get there. I call it the “Retirement Red Zone.”

Now, for all of the stock fans out there that have long believed that bonds and cash are boring – if you believe that in a low interest rate environment, it will be difficult to make a lot of money in bonds or cash – I’ll pause briefly just to make sure you know… I agree.

The S&P 500 market has gone up in 30 out of the last 40 years. By those odds, having cash out of the market is likely to cause lower returns 75% of the time. But we can’t ignore that other 25%.

The last 6 months can offer valuable insight. Most notably, it offers an opportunity to learn more about your actual risk tolerance. We experienced one of the dreaded “meaningful drawdowns“ I mentioned above. The level of angst (or lack thereof), the type of worry, and the actions you took are worth noting, and depending on them, could warrant adjustment to how you have allocated your assets.

Having a safe pool of funds allows you the time to wait out a bad market and ideally not have to sell a stock you love at a price you hate.

If we have done that first job of protecting your short-term needs, then you’ll have the freedom to be a long-term-minded investor with the rest of your portfolio. Sudden drops – like the one we just experienced – may be less jarring. And you can keep the desired amount of funds allocated towards assets that you believe will lead to better returns (within your risk tolerance, of course).

Retirement doesn’t have to be scary and market drawdowns don’t have to cause panic. It is possible to have a plan that can create peace of mind in even the most uncertain of times.