3 Annuity Tax Traps

Investors today tend to focus on three major elements in their investing: income, growth, and tax minimization. So, it makes sense that a product that might be able to offer guarantees in the income department and benefits in the tax department could sound appealing. But, beware – the tax benefits of annuities are not always what they seem.

In particular, we will address tax-deferred annuities (annuities purchased using after- tax money) and three potential tax traps..

Gains are taxed as ordinary income.

A big selling point for non-qualified variable annuities is tax deferral. Money you put into the contract can grow tax-deferred (much like it would within an IRA) and taxes are not due until distribution. For an investor in a high tax bracket the abilityto avoid an additional tax bill is a benefit. Whether you rebalance your investments inside the contract, dividends get paid, or the investments simply appreciate in value, none of that activity creates an additional tax burden.

The tax bill comes later.

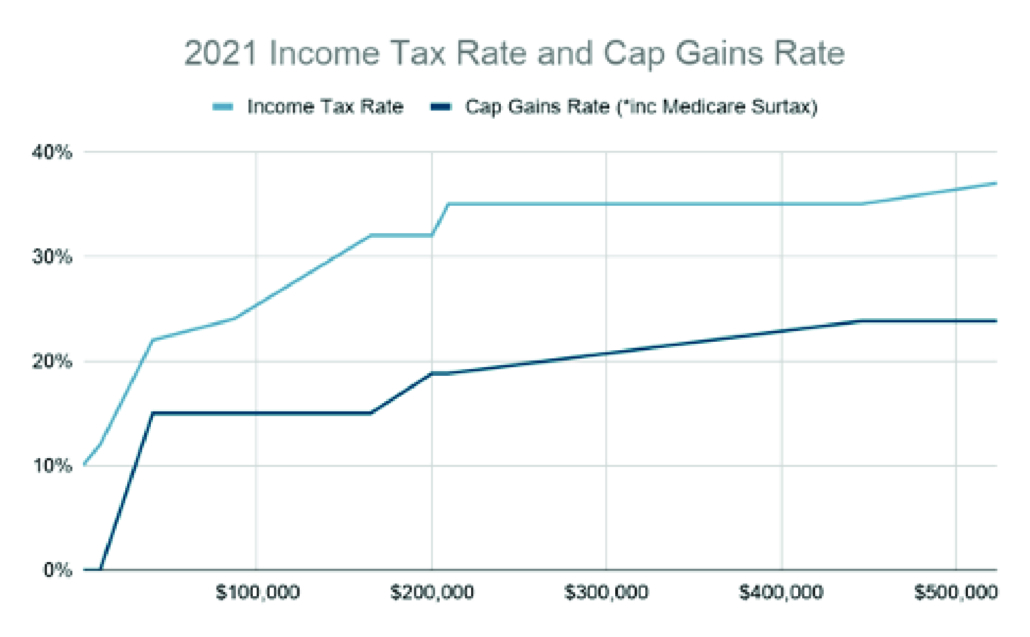

Eventually, investors want to access their funds. Upon distribution, all growth within the contract is treated as ordinary income. Ordinary income rates currently span from 10% on the low end to 37% on the high end. Had the investor held securities outside of an annuity contract, their growth may have instead been subject to long term capital gains tax rates which currently range from 0% to 23.8%, if you include the 3.8% Medicare surtax. Wherever you fall in terms of income, long term capital gains tax rates are more favorable than ordinary income tax rates.

Example:

Investor A owns an annuity contract worth $100,000 and within the contract invests in the All Stock Portfolio. They hold the contract for 10 years and it grows to $200,000. They withdraw the full amount while in the 24% income tax bracket. They will pay $24,000 in taxes (24% x $100,000 in growth).

Investor B owns $100,000 worth of the All Stock Mutual Fund, but not inside of an annuity. They hold the fund for 10 years, and it grows to $200,000. They withdraw the full amount while in the 24% income tax bracket. They will only owe $15,000 in taxes (15% x $100,000 in growth) because though their income is taxed at 24%, they fall within the 15% long term capital gains bracket.

Tax efficient portfolios can be constructed outside of annuity contracts. Securities like individual stocks are not taxed until sold and would benefit from long term capital gains tax rates if held for over a year before sale, as would qualified dividends. Municipal bonds may also be an attractive vehicle for those seeking tax efficient income.

Last In, First Out.

Annuities are subject to a disposition method called LIFO – Last In, First Out. For annuities, this means that any withdrawals from the contract must first consist of growth before you get to withdraw anything representing principal. We know that growth is taxed at ordinary income rates and, with LIFO treatment, it means that every dollar you withdraw is subject to those rates until you take enough out of your contract to only be left with tour initial purchase/investment.

This differs drastically from what investors may expect from a traditional portfolio held outside of an annuity contract. Typically, when you sell a security to take a withdrawal, that sale will consist of both basis and growth. This means that a portion of those funds will be a non-taxable return of your initial purchase.

Example:

Investor A bought an annuity for $100,000 which has since grown to $200,000. They need to take a distribution of $10,000. The full $10,000 will be taxed at ordinary income tax rates. If they are in the 24% income tax bracket, their tax bill would be $2,400[1].

Investor B bought $100,000 worth of ABC, Inc. stock. It has since grown to $200,000. They need to sell enough shares to take a $10,000 withdrawal. Upon the sale, $5,000 will represent a return of basis and not be taxable. $5,000 will be taxed at long term capital gains rates if the stock was held for more than a year. If they are in the 15% long term capital gains bracket, their tax bill would be $750.

An annuity can create drastically different experiences from a tax perspective for retirees. Having to realize ordinary income on an accelerated basis can have a broad reaching impact. For example, Medicare premiums are determined by your Modified Adjusted Gross Income (MAGI). An annuity distribution representing 100% income versus a sale partially representing a return of capital could be the difference between one Medicare premium and another.

Step up? Not today.

A strong legacy tool built into our tax code allows for appreciated property to receive a “step up” in basis when transferred upon death to help the recipient avoid capital gains taxes. While this benefit applies to many assets, it does not apply to annuities. When an annuity contract is inherited, the beneficiary will owe income taxes on growth within the annuity.

Though the timing of that tax liability may vary depending on the payout option selected by the beneficiary, an annuity does leave them with a tax bill that could have been avoided by choosing to invest outside of an annuity wrapper.

Example:

Investor A purchases an annuity contract for $100,000 which grows to $200,000. Investor A passes away. Their beneficiary will owe ordinary income taxes on the $100,000 of growth the contract experienced.

Investor B purchases shares in ABC, Inc. for $100,000 which grows to $200,000. Investor B passes away. Their beneficiary will receive a step up in basis on the shares from $100,000 to $200,000. They could immediately sell the shares for $200,000 and owe no income or capital gains taxes on the transaction.

If your financial plan consists of leaving a legacy, think about how assets will pass to your heirs and what kinds of tax implications they will face is critical. Position your assets in a way that aligns with your ultimate goals.

—

It is clear that while annuities offer some tax benefit, there are potential pitfalls. The tax rate you pay on your investment gains, and the timing of when you pay for those gains are critical concerns. And if one of your investing goals is to leave a legacy for the next generation, you should also consider the taxation of the assets you plan to leave behind.

The advisors at Craftwork Capital can help you put together a plan that can be tax sensitive[2] but also avoid the tax traps associated with tax-deferred annuities. Book a consultation today with one of our advisors today to understand whether the Craftwork platform is a fit for your unique financial situation.

[1] This example illustrates how a withdrawal is treated, not an annuitization. If a contract is annuitized, payouts are treated as a prorated combination of basis and gains. Even with an annuitization, gains are treated at ordinary income rates.

[2] Craftwork Capital is not a tax advisor. Discussions regarding taxes as part of a financial plan will be strategic in nature, but you should always consult with your tax preparer/advisor before making decisions that will impact your taxes.